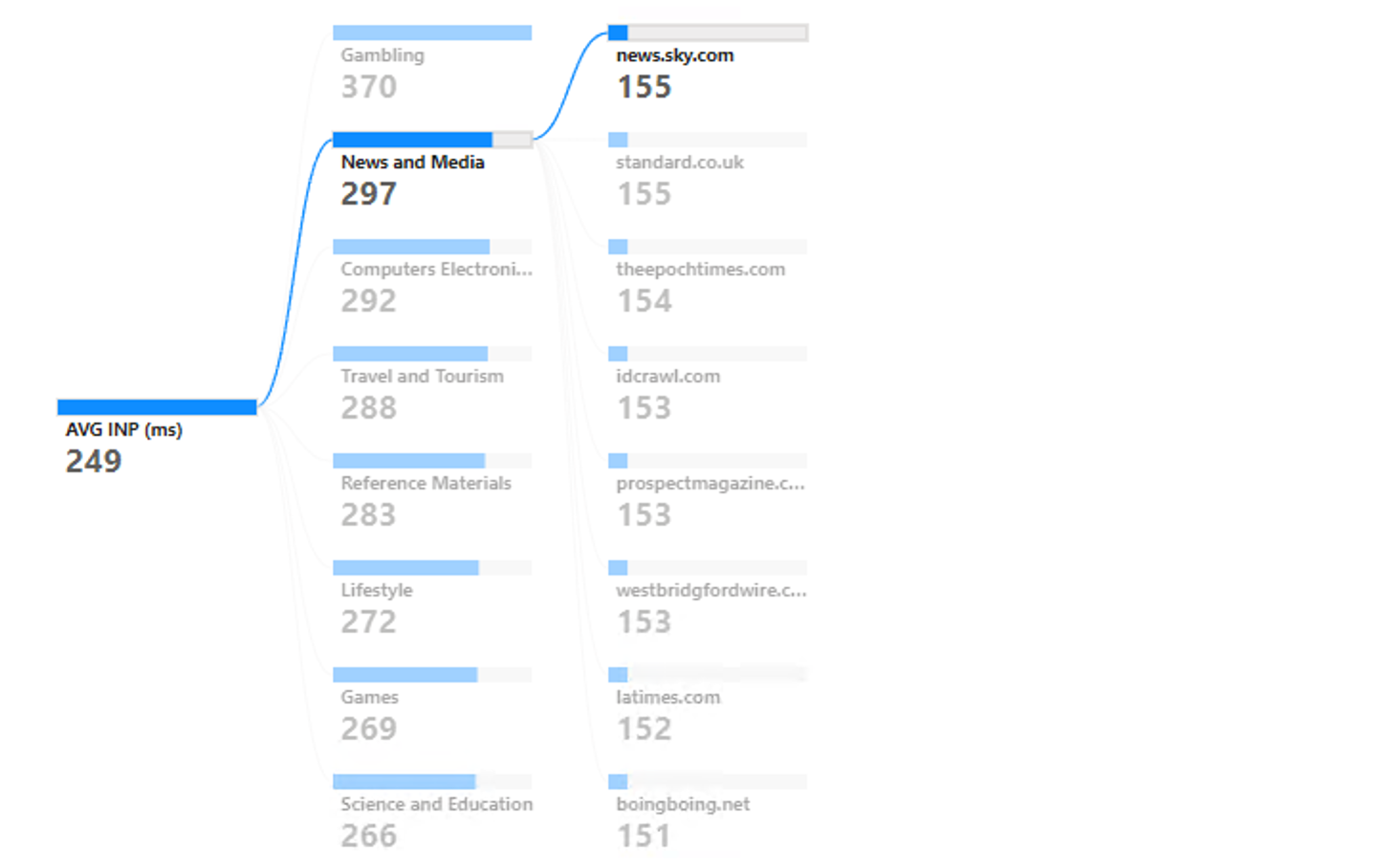

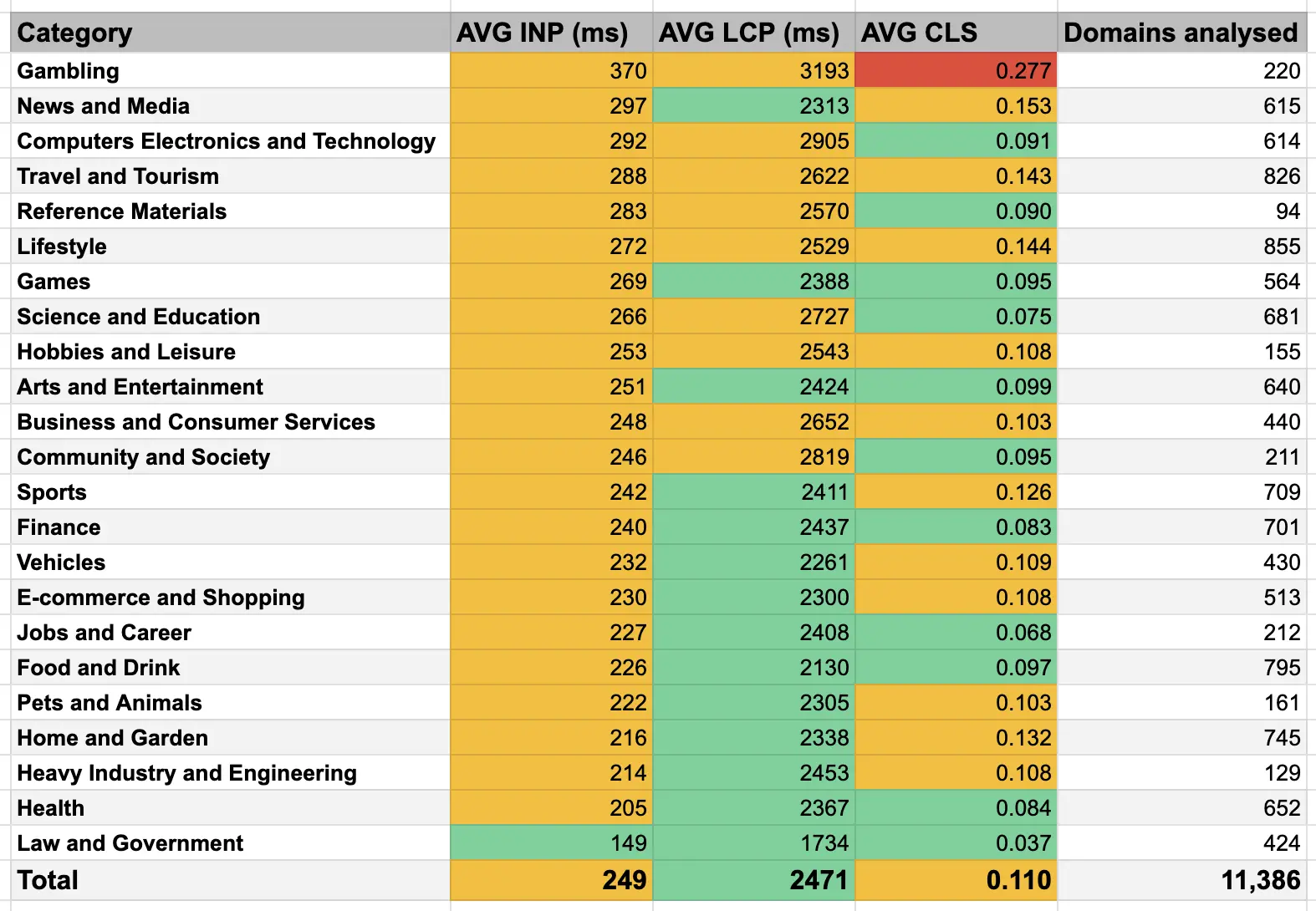

INP status of 11,386 most visited websites in the UK by sector (March 2024)

As of March 12, Google added a new metric to Search Console: Interaction to Next Paint (INP). That's one of three Core Web Vital (CWV) metrics the search engine uses in its ranking systems. INP is replacing First Input Delay (FID), whose support will end on September 9, 2024.

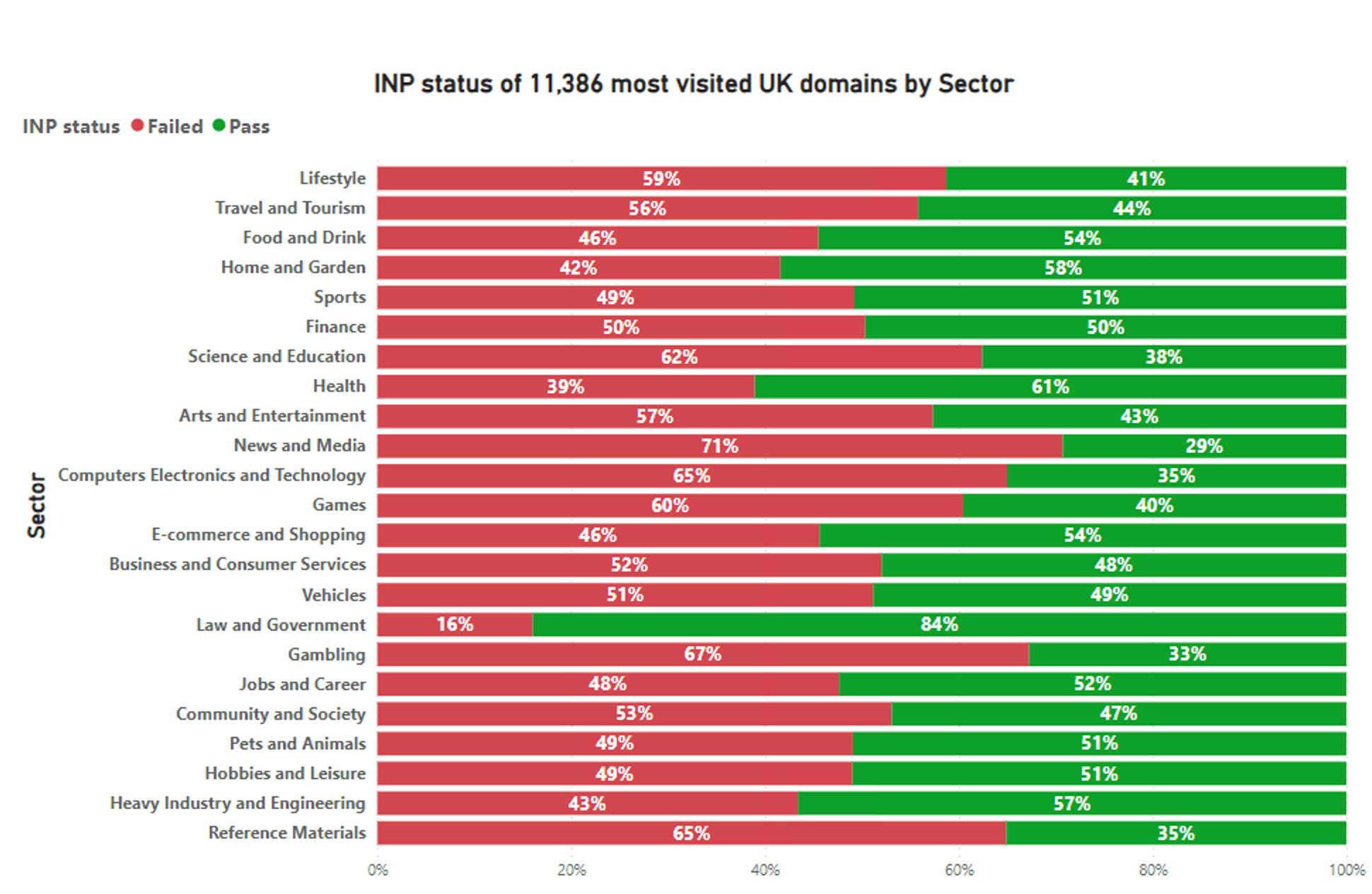

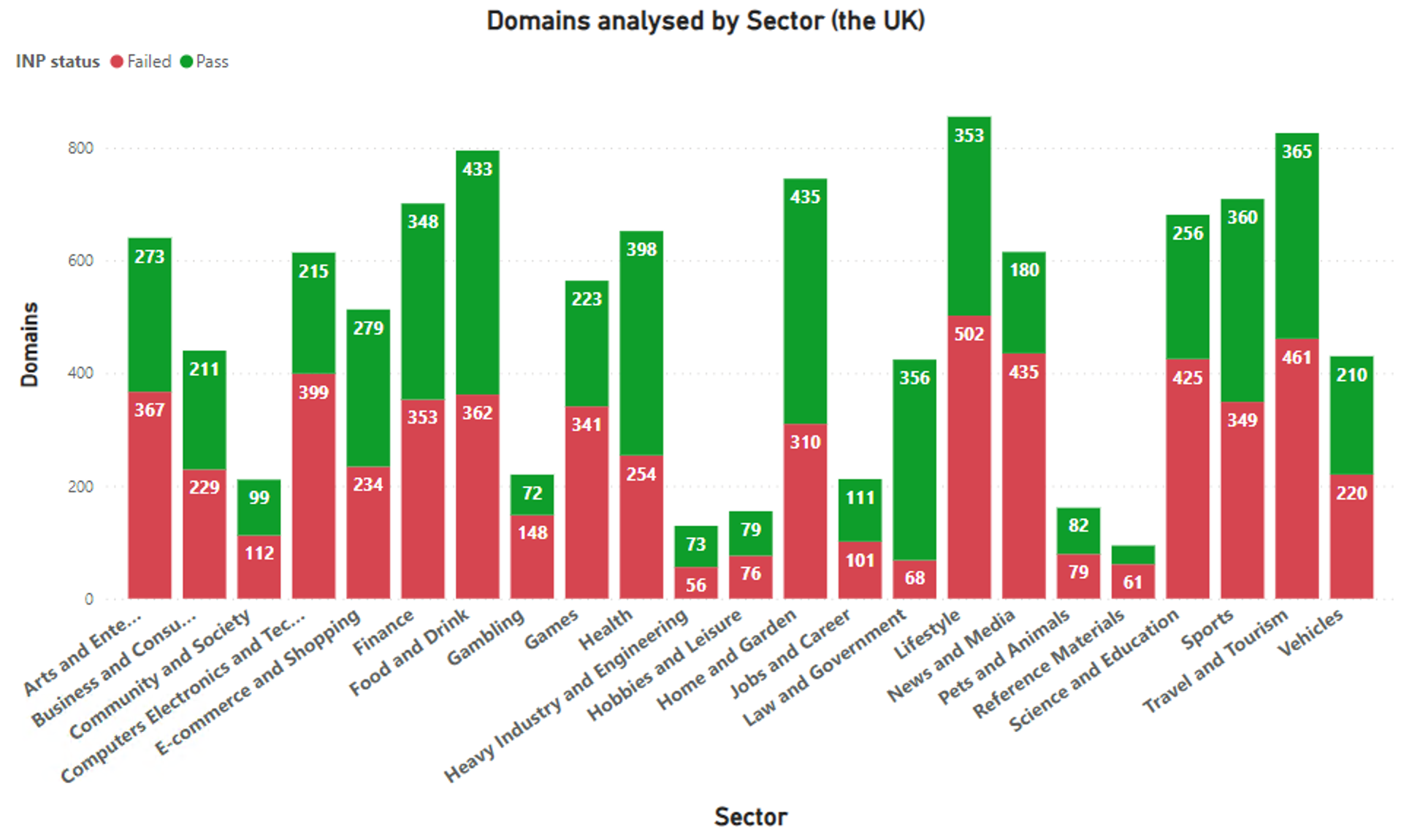

On March 13, I collected available origin data for mobile devices from the Chrome User Experience Report (CrUX) for 11,386 most visited websites (based on Similarweb traffic and Ahrefs SEO traffic value data) across 23 sectors in the United Kingdom.

What is INP?

INP measures a website's responsiveness, indicating the time it takes for a webpage to respond to a user's interaction. Alongside Largest Contentful Paint (LCP) and Cumulative Layout Shift (CLS), INP completes the triad of Core Web Vitals (CWV), offering a holistic view of a website's performance and user experience.

INP study results

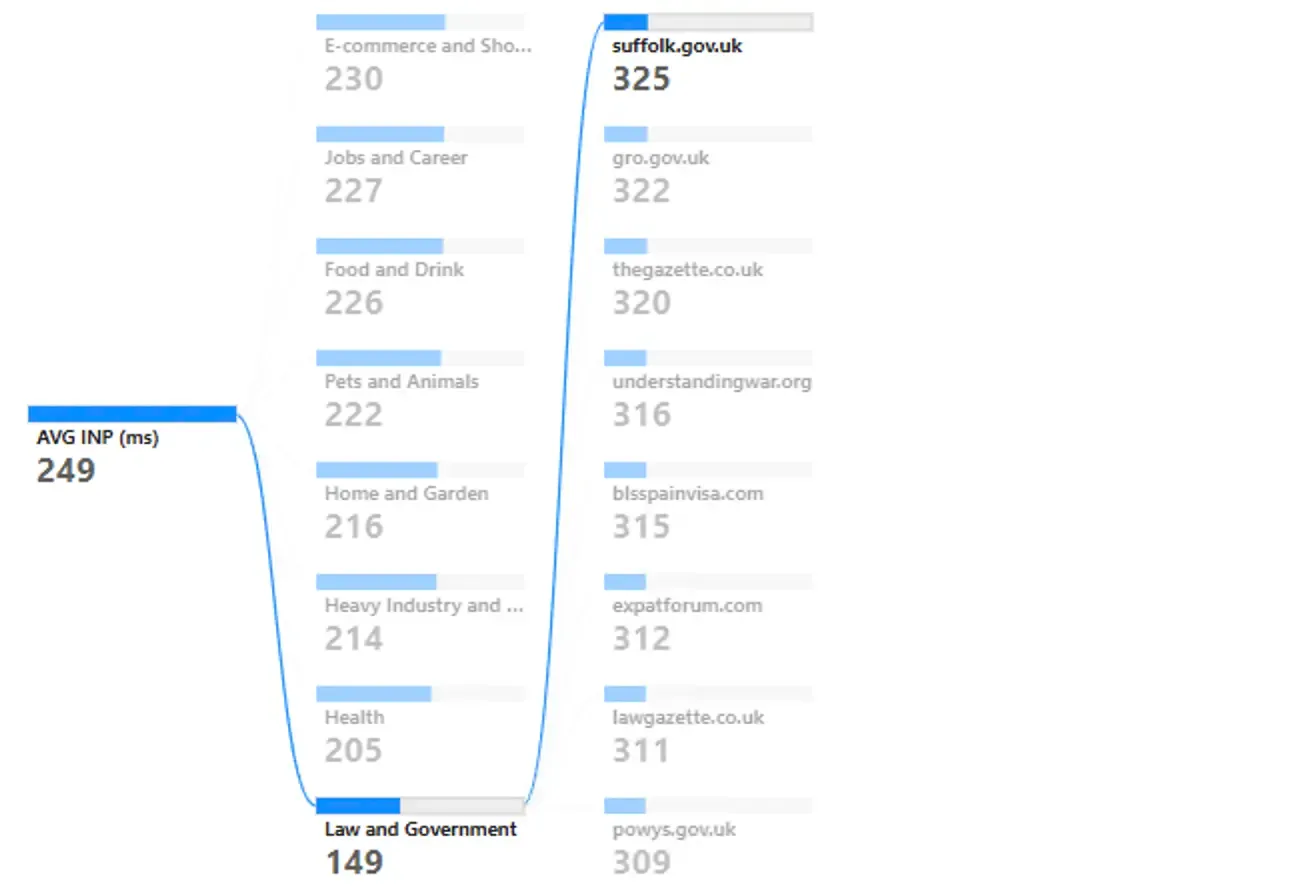

Analysing the freshly compiled data reveals that as of March 13, law and government websites unexpectedly became the only sector that passed INP with an average score of 149 ms, which is below the required 200 ms; in 84% of cases, Law and Gov websites will pass the INP score (but of course, there are exceptions, too, see them below), leaving gambling and media websites at the bottom of the list. For example, the Gambling sector shows an average INP of 370 ms, with the News and Media sector following at 297 ms.

This variability highlights the different challenges and optimisation efforts across industries. Gambling and media sites are known for their dynamic, content-rich pages that include real-time updates, multimedia, and interactive elements, which can impact performance indicators like Interaction to Next Paint (INP). Balancing engaging content with optimisation requires advanced strategies such as lazy loading and dynamic content delivery.

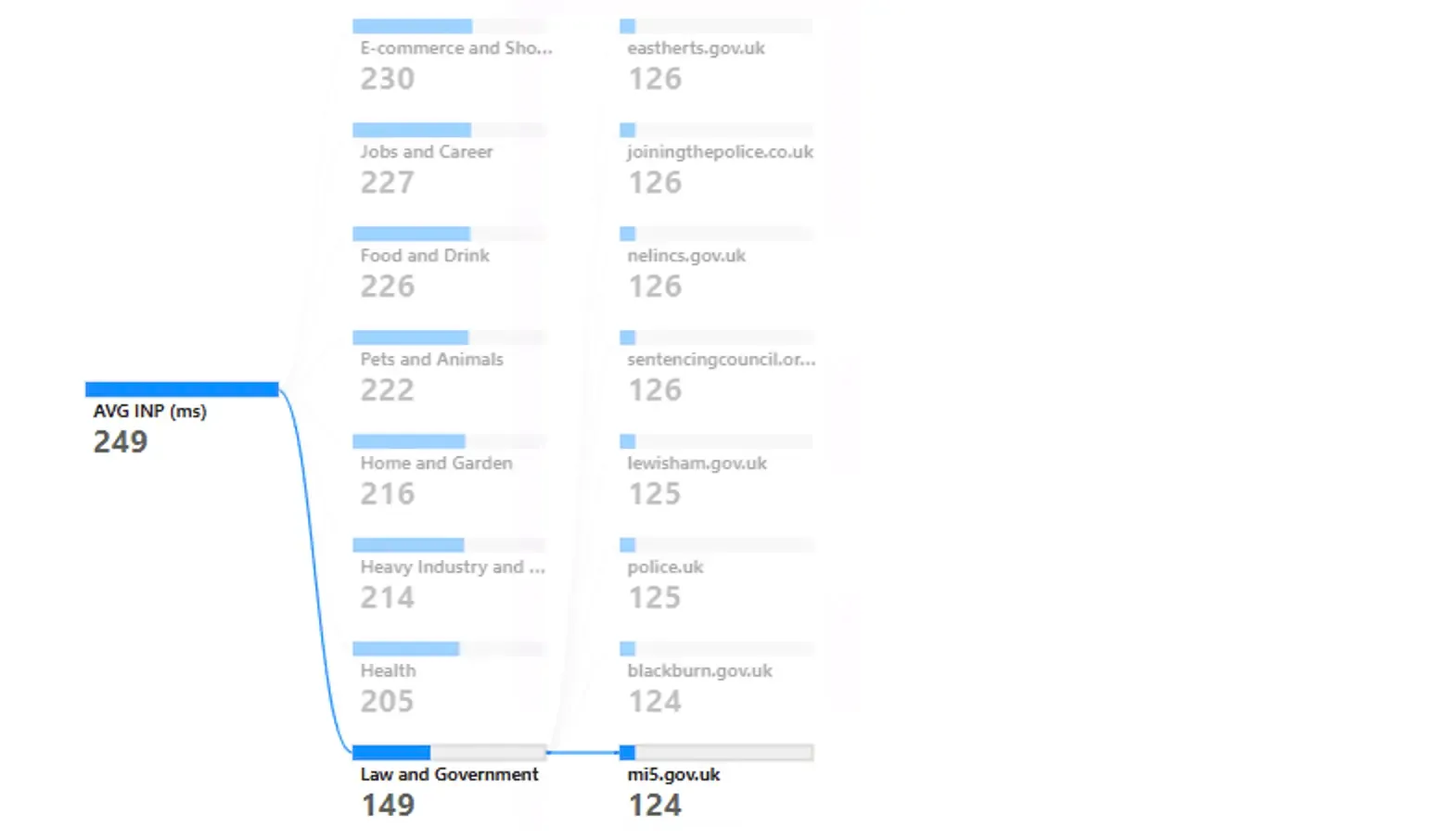

Not all gov websites pass INP

Government websites prioritise accessibility and clear information delivery, often featuring streamlined designs focused on text-based content. This approach enhances performance scores like INP, as simpler sites load and respond faster. Adherence to accessibility standards further supports optimisation efforts, contrasting with the challenges faced by content-heavy sites in maintaining performance.

Here are some examples of gov websites with a low INP score.

At the same time, most of the other gov websites (84%) have excellent INP metrics.

The gambling and media industry is at the bottom of the INP list, but some websites have excellent INP metrics, too

Core Web Vitals (CWV) and their impact on SEO rankings

The ongoing dialogue within the SEO community about Core Web Vitals (CWV) and their effect on SEO rankings has taken (hopefully) a clearer direction with recent updates from Google. The search engine has indicated that CWV, including Interaction to Next Paint (INP), is used in its ranking systems without explicitly saying that it is a ranking factor.

Consequently, Core Web Vitals are important in 2024, but they should be part of a comprehensive, holistic approach to SEO. A balanced optimisation strategy that includes CWV is essential for a potential boost in SEO rankings while also ensuring a high-quality user experience.

Methodology

Selection: SimilarWeb top-traffic websites in the UK.

Filtering: Websites with the lowest Ahrefs' organic traffic values are removed.

Data Collection: Origin data for mobile devices from CrUX API was retrieved for either 'www' or non-www' versions, with 11,386 successful results.

Analysis: Calculated industry averages using SimilarWeb sector classifications.

Study Limitations:

Industry Representation: Sectors with higher average traffic per website had more sites analysed, potentially skewing representation.

International Websites with a subfolder: Some websites that are closed for other crawlers, especially with a UK subfolder (e.g., example.com/en), may not all be included due to the inability to identify the redirect to a subfolder (yes, I always respect robots.txt rules).

Outlier Impact: Certain industries might have outliers affecting the average metrics.

Sample Diversity: Domain zones included com, net, org, uk, tv, io (and a few modern ones like ai, pro, etc.). The study focused on websites with UK search traffic.

Seasonality: The data snapshot may not fully capture seasonal or event-driven variations in web performance.